Hello, All.

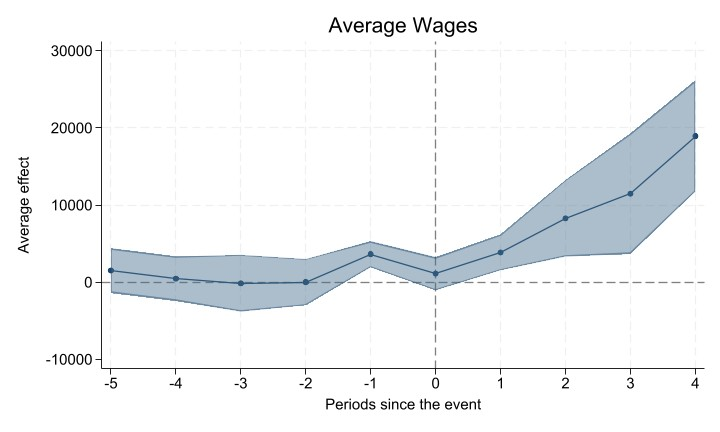

I am working on Industry Survey data from 2003 to 2011. It is a repeated cross section. My treatment is staggered between 2006 and 2011. I apply a staggered DiD model (Callaway and Sant'Anna, 2020) using the csdid package in stata. My plot is attached below. There seems to be an issue with the pre trends. The policy was federally announced in 2005 however the first treatment took place in 2006, hence I assume the issue to be anticipation in period -1. This is making it tough for me to analyze the estimate computed. How should I proceed? What facts would help me infer causation? Is there a way to control for the anticipation effects? I do not have any covariates. Any advice is appreciated!

I am working on Industry Survey data from 2003 to 2011. It is a repeated cross section. My treatment is staggered between 2006 and 2011. I apply a staggered DiD model (Callaway and Sant'Anna, 2020) using the csdid package in stata. My plot is attached below. There seems to be an issue with the pre trends. The policy was federally announced in 2005 however the first treatment took place in 2006, hence I assume the issue to be anticipation in period -1. This is making it tough for me to analyze the estimate computed. How should I proceed? What facts would help me infer causation? Is there a way to control for the anticipation effects? I do not have any covariates. Any advice is appreciated!

Comment